31 October 2023 – Spectris plc (SXS: LSE), the expert in providing insight through precision measurement, provides a trading update for the three-month period ended 30 September 2023 (‘the period’).

Continued momentum with strong sales growth in Q3; full year operating profit expected to be in the top half of guidance range

- Double-digit sales growth in Q3 supported by our strong order book:

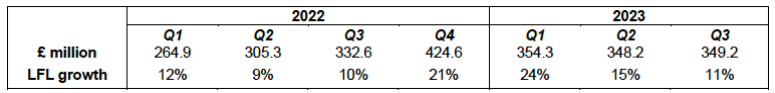

- Q3 like-for-like (LFL) sales growth of 11% (growth of 5% on a reported basis)

- Year-to-date LFL sales growth of 16% and book-to-bill of 0.97x

- Demand has now broadly normalised with our backlog and lead times returning to more typical levels

- Strong progress on margins, particularly in Spectris Dynamics

- Balance sheet providing capital allocation optionality:

- Net cash of £164.1 million at period end

- Completion of four acquisitions (totalling £58.4 million) since the half year, supporting growth

- On track to complete the final part of our £300 million buy back by the end of the year

- Guidance and outlook:

- Order book visibility provides confidence in the outlook

- For the financial year 2023, we now expect to deliver:

- LFL sales growth of around 10%

- Strong progress on margins, with adjusted operating profit in the upper half of our guidance range of £250 million to £265 million

- Looking further ahead to 2024, we expect another year of progress, including further margin expansion

Andrew Heath, Chief Executive, said:

“We continued to make excellent progress with another quarter of double-digit sales growth underpinned by new product launches and sustainability drivers and I want to thank all our people for their hard work in delivering these results. I am delighted with the continuing progress we make on margins reflecting not only our sales growth but also our focus on delivering operational efficiencies.

Our performance in the third quarter provides further evidence of the improved quality and strength of the Group and represents another step towards the delivery of our medium-term targets. Our balance sheet provides us with flexibility for continued investment in growth as evidenced by the acquisitions completed during the period.

While remaining alive to the broader macro-economic environment, the Group’s resilience, demonstrated by our order momentum, leading product portfolio and broad end market exposure, combined with a strong self-help story, gives me confidence in delivering our guidance for this year and another year of progress in 2024.”

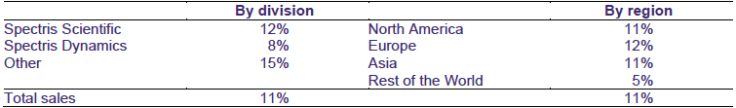

Sales by geography and division – LFL growth Q3 2023 vs Q3 2022

Group sales increased by 5% (£16.6 million) to £349.2 million (Q3 2022: £332.6 million). LFL sales increased 11% with good growth across all regions, with the impact of disposals, net of acquisitions, reducing sales by 1% and foreign currency exchange reducing sales by 5%.

- Spectris Scientific continued to perform strongly in the quarter, with double-digit increase in LFL sales and growth across all regions, continuing the momentum from the first half. Customer order intake has now normalised across life sciences/pharmaceuticals and semi-conductor end markets. On a year-to-date basis, demand in metals, minerals & mining and academia were ahead of the comparative period.

- Spectris Dynamics also performed strongly with double-digit LFL sales growth in North America and Europe, partially offset by softer sales in Asia. Order intake in Q3 grew versus the comparative period, with demand up across A&D, automotive and academia, partially offset by softer demand in machine manufacturing particularly in China, where we continue to see some order intake normalisation.

Strong balance sheet providing investment for growth

- The Group had net cash of £164.1 million at the end of the period (£214.3 million at 30 June 2023), positioning us to continue to deliver R&D investment at 8% of sales, with capacity to compound growth through M&A aligned with the Group’s strategy

- Since our interim results, we have completed four acquisitions:

- In Spectris Scientific:

- A minority investment of £7.8 million ($10 million) in LumaCyte Incorporated, a bioanalytic instrumentation company, providing further exposure and deeper insights into the high growth Cell & Gene Therapy and vaccine markets;

- The acquisition of EMS, a long-established partner and exclusive distributor of PMS products in the UK and Ireland for a headline value of £6.9 million (€8 million), which further strengthens our regional services offering;

- The acquisition of the x-ray diffraction product line from Freiberg Instruments for total consideration of up to £12.9 million (€15 million). The acquisition of crystal orientation metrology tools provides complementary solutions to our existing semiconductor portfolio allowing us to further respond to the industry requirement to improve yields and performance; and

- In Spectris Dynamics:

- The acquisition of MicroStrain Sensing Systems business, a leading developer of inertial and wireless sensing systems, for a headline value of £30.8 million ($37.6 million)

- In Spectris Scientific:

- During the period, we continued our £300 million share buyback programme (£264 million completed as at 30 September 2023) which we expect to complete by the end of the year

Quarterly Group sales

Conference call

A conference call for analysts and investors will be hosted by Andrew Heath, Chief Executive, and Derek Harding, Chief Financial Officer, at 08.30 today to discuss this statement. To access the call, please dial +44 (0) 20 4587 0498, toll free +44 (0) 800 358 1035 – Participant code: 746319. Or for replay, please dial +44 (0) 20 3936 3001 – Participant code: 706067.

Spectris will publish its full-year results for 2023 on 29 February 2024.

For and on behalf of Spectris plc

LEI Number: 213800Z4CO2CZO3M3T10

Contacts:

Spectris plc

Mathew Wootton

Investor Relations Director +44 7500 078 880

Teneo

Martin Robinson/Giles Kernick

+44 20 7353 4200

1 Concept Life Sciences contributed £23.9 million of sales and £0.2 million of operating profit in 2022

2 The Omega business has been classified as a discontinued operation. Accordingly, the financial statements for the current and comparative years have been amended to show continuing operations.